Foreign companies, employing staff in Europe, need to comply with European legislation and are obliged to pay taxes and social security contributions in Europe for their staff, even if they have no local office in Europe and operate from their home country.

Our Services

- End to end “Payroll Management System”

- Local contract and payroll processing

- Monthly and yearly payroll reports

- Audit reports and declarations

- Employee exit and de-registration

- Health insurance, Tax, Social Security registration, and filling services

- First-time insurance consulting service

- Tax saving consulting from our Tax Lawyer

- Employee reference letters

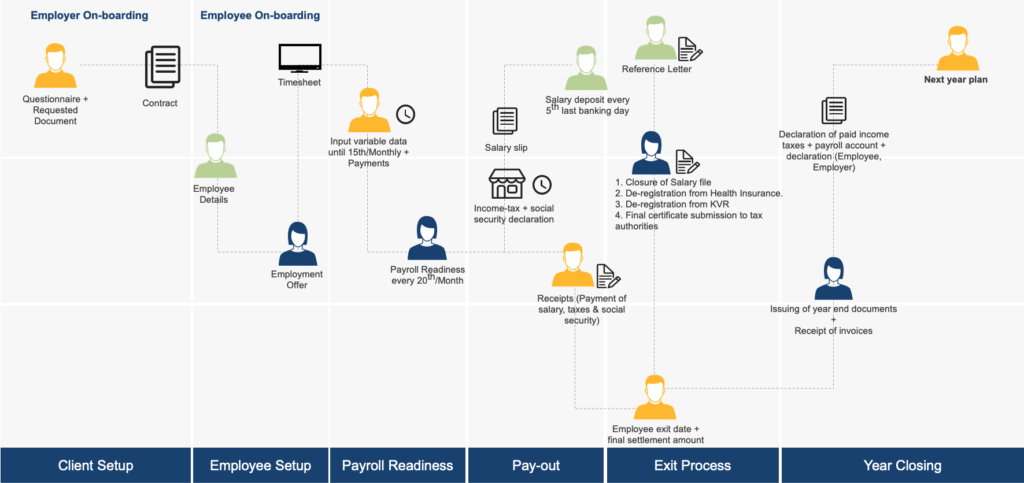

Process